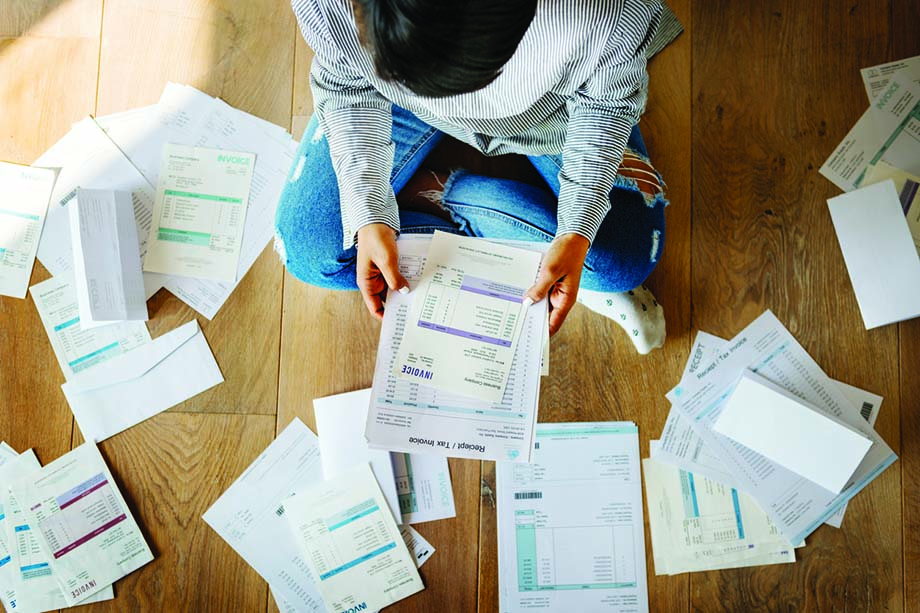

It’s hard enough to get out of bed when you’re buried in bills.

Just the thought of trying to get out of debt spurs depressive symptoms.

How to stress less about money

Set small, realistic goals for yourself

You may have credit card, student loan debt, or a car loan — which adds up to an amount of money that’s difficult to stomach. It’s easy to feel discouraged and hopeless in the face of such a high price tag, so try breaking it down into smaller, more manageable pieces to focus on.

Instead of being downcast by how large your credit card balance is, try hiding your credit card in your house (somewhere you won’t be able to quickly use it) and pay a little over the minimum payment required each month.

Don’t focus on how much money it will take to pay the entire balance off, set a small goal of paying down $200 to start, then $400, and so on. It may not seem like you’re making significant progress at first, but over a few months, you may start to feel better as you see the balance slowly become more manageable.

Offer yourself a little grace

If you keep telling yourself that your problems are too big, or you aren’t the kind of person that can fix them, it can feel impossible to improve your situation. Our ego is our mind’s understanding of ourselves, and debt can cause us to feel unworthy. You are worthy and deserving of all that is good. Your financial problems are how you are, not who you are. By reframing your situation as a challenge that you’re learning to overcome, you can work to break the cycle of negativity.

Stop the self-flagellation and self-judgment and practice acceptance of your financial situation. Extend yourself the same empathy and compassion you would demonstrate to others.

If you don’t already have a diagnosis or treatment plan, you can reach out to a health professional to discuss treatment options like medications and therapy.